There are a lot of people who import brand new vehicles in Kenya every year, but one thing that even some of the most experienced car importers don’t know is how to calculate the import taxes for a new vehicle. Unlike taxes for a used vehicle which are usually calculated using the date of manufacture for the car in question (Click here to know how to calculate import taxes for a used vehicle), the import taxes for a new unit is always calculated based on the invoice value.

To best explain this process, we will use an example. A Toyota Landcruiser Prado. The price of a brand new Toyota Landcruiser Prado in most countries averages at KES 8,000,000 depending on the trim.

1. Calculate import duty

To start with you will get 25% of the invoice value to get the import duty. So for our example above we will do 25% of 8,000,000 to get the import duty of our brand new Toyota Landcruiser Prado. Since our invoice value is 8,000,000, then:

25%x8,000,000=2,000,000

Import duty=2,000,000

2. Calculate excise value

Next, we will need to add the import duty to the invoice value to get the excise value. In our example above that will be:

8,000,000+2,000,000=10,000,000

Excise value=10,000,000

3. Calculate excise amount

Next, we will do 35% of the excise value to get the excise amount.

35%x10,000,000=3,500,000

Excise amount=3,500,000

4. Calculate VAT value

Now, we will add the excise amount to the excise value to get the VAT value. In our above example:

10,000,000+3,500,000=13,500,000

VAT value=13,500,000

5. Calculate VAT amount

Now, we will do 16% of VAT value to get the VAT amount.

16%x13,500,000=2,160,000

VAT amount=2,160,000

6. Calculate Railway Development Levy (RDL)

To get the RDL, we will now do 2% of the invoice value. In our example above:

2%x8,000,000=160,000

RDL=160,000

7. Calculate Import Declaration Form (IDF) fees

To get the IDF, we will do 3.5% of the invoice value, in our example, that will be:

3.5%x8,000,000=280,000

IDF=280,000

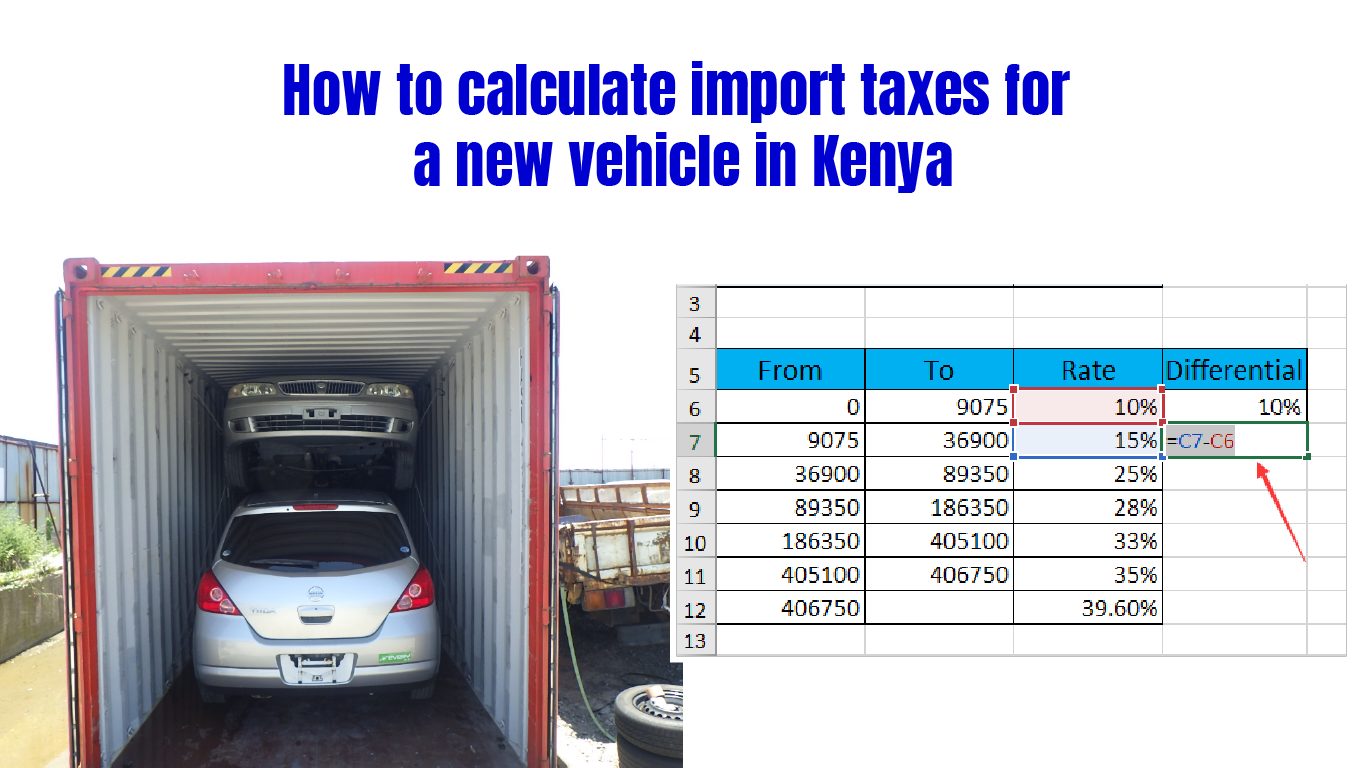

8. Registration fee

Registration fee is charged based on the engine size (CC) of the car. Below is a chart of the charges:

Since our Toyota Prado is 2700 CC, we will pay KES 18,775

9. Total payable taxes

Finally, to calculate the total payable taxes, we will now add the import duty, excise amount, VAT amount, RDL, IDF, and Registration

Import duty=2,000,000

Excise amount=3,500,000

VAT amount=2,160,000

RDL=160,000

IDF=280,000

Registration fee=18,775

Total payable taxes=8,118,775

Conclusion

As you can see from the example above, there is a disadvantage to importing a new car in comparison to buying locally assembled models. The main one being that you will have to pay import duty, and worse still, the duty is so high, more often than not it is higher than the cost of the car itself, while there are still other importation and clearance costs outside of the import taxes.

But there are many reasons why one would want to import a brand new vehicle into the country. The main reason being that the vehicle is not available locally. If you ever need to import and clear a brand new vehicle, seaways Kenya Limited is the place to be.

Seaways Kenya LTD is the leading logistics, freight forwarder, and customs broker in East Africa. We can help you choose the right car, make sure it complies with all regulations, handle the shipping and clearance process and deliver your vehicle to your doorstep. Seaways Ltd has been in operation for over 30 years and is offering you over 30 years of professional experience in the importation and logistics industry.

Thank you for this impressive report. I am refreshed following reading this. Thank you!