How car importers can take advantage of the new K.R.A Exercise Duty Bill to save big.

The new 2015 KRA Excise Duty bill has been received with mixed reactions especially among Kenyan car importers. The bill imposed by the Kenya Revenue Authority puts a new fixed tariff on the excise duty. As of 1st December 2015, All cars 3 years old or younger would attract a fixed Excise duty rate of KES 150,000, While those older than 3 years would be taxed at a flat excise duty fee of 200,000/=. What this means is that if your car falls below the bracket of 1.0 Million in Value, your overall customs duty tax may end up increasing by a factor of almost up to 50%. On the flip side those who can afford cars worth 5 Million & above may end up saving up to 700,000KES in taxes. The mixed reactions therefore come as no surprise. Seaways, one of the most experienced specialized car import logistics organizations in Kenya, has taken the lead in updating their already popular propriety duty calculator to reflect the latest changes from KRA. To know the total cost of customs duty and clearance charges for your imported car sign up for free today at www.myseaways.net. The new policy obviously has its fair share of flaws that seem to contribute to the widening gap between the rich and the not so rich. If highlighting these flaws would lead to a change in the law, trust me, we would have done so with unrivalled zeal. However, the reality is that the excise duty bill is here to stay and the earlier we find a way of happily co-existing with it the better. The main purpose of this write up is therefore to show you how you can take most advantage of the new bill and use it to save on the import of your car in the long run.

How Customs Duty is Calculated

K.R.A Duty Calculator Breakdown

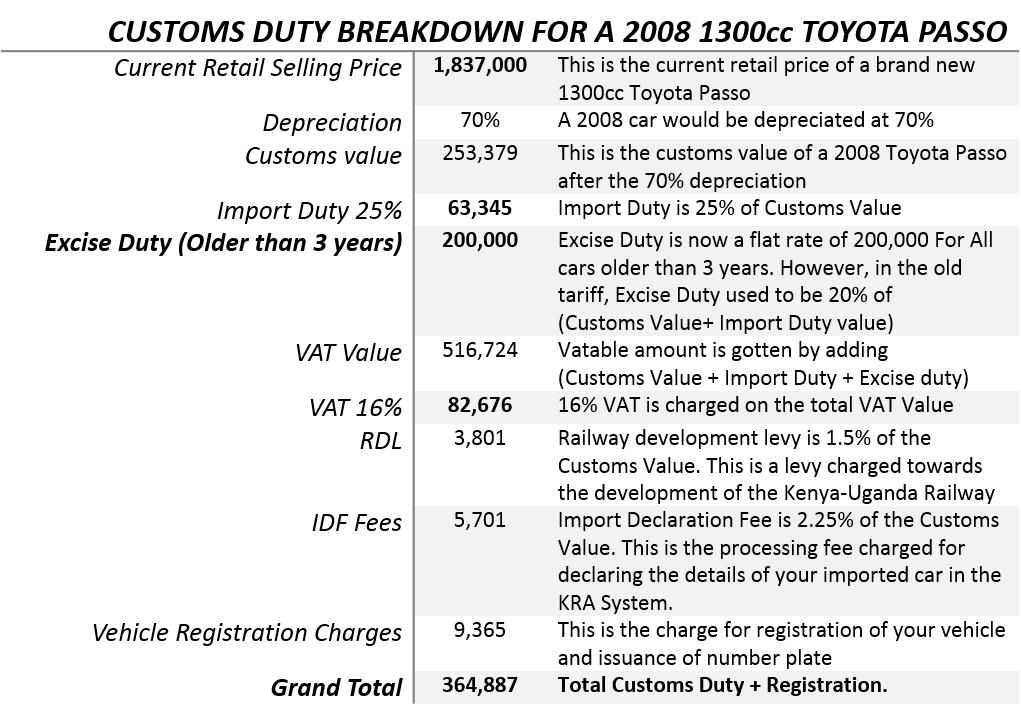

1. HOW CUSTOMS DUTY IS CALCULATED: KRA have come up with a standard retail value for every car make and model. The retail value reflects the total sale price of the car when its brand new. The retail value would then be depreciated at a certain rate to arrive at the (Customs Value) of your used car given its year of manufacture. The depreciation rate is dependent on the age of the car. Import Duty (25%), Excise Duty and VAT (16%) are all charged on the Customs Value of the car. On the right we have a table showing a typical breakdown of the tax charged on a 2008 1300cc Toyota Passo. Each cost item has been explained to help you gain deeper insight.

Difference Between Old & New KRA Excise Bill

Under the old tariff the Excise Duty was 20% of the Excise Value. The Excise Value was obtained from adding (Customs Value + Import Duty). Now the Excise Duty is a flat fee of either 200,000/= For all cars older than 3 years and 150,000/= For all cars 3 years old or younger. The table below picks 3 cars in different categories and shows how the difference in tax value between the old tariff and the new tariff.

How to Save on Tax in the Long Run

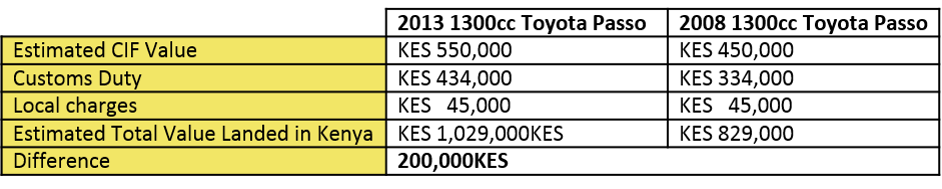

From the table above its clear to see, the cheaper your car is, the higher the incremental charge on customs duty will be. That therefore leaves us with the one critical question, “How does one buying a low end value vehicle save on customs duty?” To answer this effectively, we need to first understand the original intended spirit of the law. We need to find answers to the following question. “Why are cars 3 years old or younger taxed lower than their older counterparts?” “ Why have a flat rate tax for cars with different values” We could argue that the act of encouraging the import of newer cars is tied to the bigger notion of preserving the environment, through less fuel consumption, less pollution and fewer breakdowns. We could also argue that since newer cars need less maintenance the country would save on foreign exchange as a result of reduced imports on spare parts. One big flaw that all this argument overlook though is the impact on the car import industries. However this would be a discussion for another day. The flat rate tax would earn the government more revenue assuming a majority of the cars imported are of the lower end value. Equipped with this understanding we could conclude that it would be more favourable purchasing a new car than an older one. Given that: 1. Newer car would give you a longer term service 2. There would be reduced costs in maintenance 3. There would be savings in the fuel 4. There would be savings in the Excise duty tax Therefore, should you be thinking of purchasing a Toyota Passo for example, It would be better for you to buy a 2013 model than a 2008 model. You would also be shocked at the price difference between the two. Have a look at the table below

There you have it folks, for just 200,000/= More, you would get yourself a 2013 model car that would give savings on fuel consumption due to newer engine, savings on maintenance, a longer utility period and most importantly contribute to a better environment. You would also save 50,000KES on Excise duty as a result. This would lead to greater savings in the long run.

About Us

Seaways is a specialized car import & logistics company that was established in 1987. Our unprecedented advancements in car import logistics technology and our expansive wealth in experience sets us apart as one of the leading motor vehicle logistics experts in Kenya. Our propriety customer portal lets you calculate duty, get comprehensive quotes for clearing and delivering your car, place orders for clearing your car online and track the clearance progress together with all your payments and necessary documents all in one place. For the first time the experience of clearing your car from the port has been made stress free and convenient. Sign up for free at www.myseaways.net for more.

Our Contacts

Call Us:

+254709925000, +254736458080

Email Us:

Reach Out:

Yaya Center 3rd Floor,

Argwings Kodhek Rd, Hurlingham.

P.O. Box 62918-00200, Nairobi.

Contact Us

Please leave your contact info and we will contact you back

Hello mate, I just wanted to tell you that this article was actually helpful for me. I was fortunate to take the tips you actually so kindly shared and even put it to use. Your web blog article truly aided me and i also would like to inform your dedicated audience that they really have someone that has her or his thoughts fixed. Thank you once more for the excellent posting. I’ve truly bookmarked this on my favored online bookmarking web site and i also recommend everyone else do the very same.