Complete Guide to Importing a Car to Kenya in 2026. Everything You Need to Know

Importing a car to Kenya in 2026 is no longer a casual decision you make off hearsay or old blog posts. Regulations are enforced more strictly, valuation systems are more automated, and the cost of getting it wrong is noticeably higher than it was even a few years ago.

Still, importing remains the preferred route for many Kenyans. The vehicle quality is better, mileage is more predictable, and the variety available abroad, especially from Japan, is hard to match locally. What has changed is the margin for error.

This guide is designed as a single source of truth for anyone importing a car into Kenya in 2026. Whether you are a first-time buyer, a car dealer, a returning resident, or importing an electric vehicle, this page walks you through the entire process in detail.

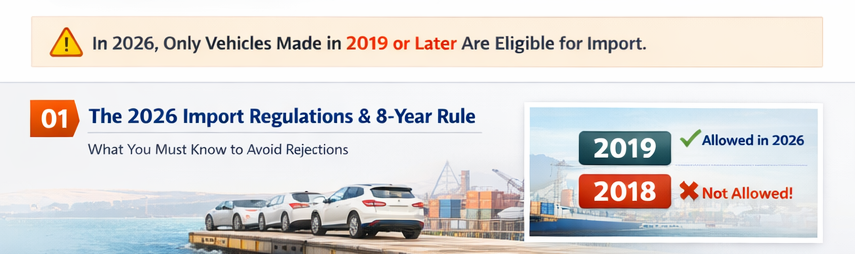

Important 2026 Rule:

Only vehicles manufactured in 2019 or later are eligible for import into Kenya.

With over 35 years of experience, Seaways Kenya has overseen thousands of vehicle imports through the Port of Mombasa. The insights below reflect what actually happens on the ground, not just what the law says on paper.

1. The 2026 Import Regulations & the 8-Year Rule

Kenya’s vehicle import rules are structured to control environmental impact, road safety, and vehicle quality. In 2026, enforcement is firm, and exceptions are rare.

The 2019 Threshold. Why 2019 Is the Oldest Allowed Year of Manufacture

The 8-year rule is calculated strictly from the year of manufacture, not the year of first registration.

In practical terms:

- In 2026, the oldest acceptable manufacture year is 2019

- A vehicle manufactured in December 2018 is not eligible

- Even if a car was registered in 2019, the manufacture date still applies

This detail trips up many buyers, especially when dealing with UK vehicles where registration dates are more prominent than manufacture dates.

Manufacture year is confirmed through:

- Export certificates

- Chassis number decoding

- Pre-export inspection reports

Seaways Kenya verifies this information before shipping, preventing costly rejections at the port.

Right-Hand Drive (RHD) Requirements. What Is Allowed and What Is Not

Kenya operates a right-hand drive only policy for standard vehicles.

Allowed:

- Right-hand drive passenger vehicles

- Right-hand drive commercial vehicles

Not allowed:

- Left-hand drive passenger cars

- Converted vehicles with steering modifications

Limited exceptions apply only to:

- Diplomatic vehicles

- UN and embassy imports

- Special-purpose machinery

For individual buyers and dealers, the safest assumption is simple. If it is not RHD, do not buy it.

Platforms such as garimoto.net, supported by Seaways, only list vehicles that already meet Kenya’s RHD requirements.

Roadworthiness Inspections (QISJ, EAA & Others)

Every used vehicle imported into Kenya must pass a mandatory pre-export inspection.

Common inspection bodies include:

- QISJ (Japan)

- EAA

- Other KEBS-approved agents depending on origin country

Inspections cover:

- Structural integrity and accident damage

- Engine and transmission condition

- Brake and suspension systems

- Mileage verification

- Emissions standards

- Chassis and engine number authenticity

A failed inspection can result in:

- Shipment cancellation

- Re-export at the owner’s cost

- Destruction under KEBS directive

Seaways coordinates inspections early and reviews reports in detail to reduce port-side risk.

2. Step-by-Step. The Car Importation Process in 2026

Understanding the sequence matters. Many delays occur not because of rules, but because steps are done in the wrong order.

Step 1. Sourcing the Right Vehicle

Sourcing determines everything that follows. Price, duty, compliance, and timelines all begin here.

Buyers typically source vehicles from:

- Japan

- United Kingdom

- Thailand

- South Africa

For reduced risk, many buyers now start with curated platforms.

👉 Browse Kenya-compliant 2019+ vehicles on garimoto.net

Vehicles listed through GariMoto are checked for:

- Manufacture year compliance

- Export eligibility

- Authentic mileage and grading

- Suitability for Kenyan regulations

Seaways works closely with sourcing partners to ensure vehicles selected will clear smoothly in Kenya.

Step 2. Pre-Shipment Inspection

Once a vehicle is selected, inspection is mandatory before shipment.

This step ensures:

- The car meets KEBS requirements

- Manufacture year is confirmed

- Mechanical condition aligns with declaration

- Documentation matches physical vehicle details

Skipping inspection or delaying it until shipping is booked often leads to expensive cancellations. Seaways schedules inspections immediately after purchase confirmation.

Step 3. Shipping & Documentation

After inspection approval, the vehicle is prepared for shipping.

Common shipping methods:

- RoRo (Roll-on Roll-off) for standard vehicles

- Container shipping for luxury, classic, or multiple units

Key documents prepared include:

- Bill of Lading

- Export Certificate

- Inspection Certificate

- Commercial Invoice

- Packing List where applicable

Seaways manages shipping bookings, document verification, and pre-arrival coordination with Kenyan authorities.

Step 4. KRA Clearing & Duty Payment

This is the most sensitive stage of the process.

KRA does not calculate duty based on your purchase price. Instead, it uses the Current Retail Selling Price (CRSP) system.

Duty is calculated based on:

- Vehicle model and trim

- Engine capacity

- Fuel type

- Vehicle category

Before committing to a purchase, buyers are strongly advised to calculate duty accurately.

👉 Use the real-time 2026 duty calculator at logistics.seaways.net

Seaways’ licensed clearing agents handle:

- Customs entries

- KRA valuation queries

- Duty payment processing

- Port release coordination

Step 5. NTSA Registration & Number Plates

After clearance:

- The vehicle is registered with NTSA

- Kenyan logbook is processed

- Number plates are issued

Seaways assists clients through final registration to ensure the vehicle is legally ready for Kenyan roads.

3. Calculating Import Taxes and Duties in 2026

Car duty in Kenya is layered, and misunderstanding even one component can skew your budget significantly.

Components of Car Duty Explained

Import Duty

Typically 35 percent of the CRSP value

Excise Duty

Varies depending on:

- Engine capacity (CC)

- Fuel type

- Hybrid or electric classification

Value Added Tax (VAT)

Charged at 16 percent

Import Declaration Fee (IDF)

3.5 percent of the customs value

Railway Development Levy (RDL)

2 percent of the customs value

Because each charge builds on the previous one, small valuation differences can translate into large final figures.

Pro Tip:

Never rely on estimates from informal sources. Use Seaways’ real-time 2026 duty calculator before buying.

4. Importing Electric & Hybrid Vehicles to Kenya

Electric and hybrid vehicles are no longer niche imports in Kenya.

Tax Incentives in 2026

To encourage greener transport, Kenya applies:

- Lower excise duty rates for EVs

- Reduced overall tax burden compared to petrol or diesel vehicles

This has made electric vehicles increasingly attractive for:

- Urban commuters

- Corporate fleets

- Ride-hailing operators

Charging Infrastructure Growth

Charging infrastructure continues to expand, particularly in:

- Nairobi

- Mombasa

- Major highways and commercial centers

While infrastructure is still developing, it is now sufficient for daily urban use. Seaways supports EV importers with category-specific compliance and clearance guidance.

5. Special Categories. Returning Residents & Diplomats

Some importers qualify for tax exemptions or reductions.

Returning Resident Exemptions

To qualify:

- You must have lived abroad for at least two continuous years

- You must have owned the vehicle for at least 12 months

- The vehicle must be imported within the allowed return period

Failure to meet even one condition disqualifies the exemption.

Required Documentation

Typical documents include:

- Passport with entry and exit stamps

- KRA PIN certificate

- Proof of residence abroad

- Original logbook

Seaways reviews documentation before shipping to confirm eligibility and prevent exemption denial.

6. Why Choose Seaways for Your 2026 Import

Many agents offer shipping. Few offer accountability.

End-to-End Visibility

Clients track shipments, clearance stages, and documentation through logistics.seaways.net. This transparency reduces anxiety and delays.

Trusted Vehicle Sourcing

Vehicles on garimoto.net are vetted before listing, reducing compliance risk before payment.

Local Expertise at Mombasa Port

Seaways operates with:

- Licensed KRA clearing agents

- Physical offices near the Port of Mombasa

- Direct coordination with customs and port authorities

Local presence often makes the difference between smooth clearance and prolonged delays.

7. Frequently Asked Questions (FAQs)

No. Kenya enforces an 8-year age limit. In 2026, only vehicles manufactured in 2019 or later are allowed.

Shipping from Japan to Mombasa typically takes between 25 and 35 days, depending on the port of origin and vessel schedule.

Import duty is calculated using the CRSP value and includes import duty, excise duty, VAT, IDF, and RDL. Using a real-time duty calculator gives the most accurate estimate.

Ex-Japan is usually cheaper due to predictable CRSP values and lower purchase prices. UK imports can still make sense for specific models.

Ready to Import in 2026?

👉 Search 2019+ Compliant Vehicles on GariMoto

👉 Calculate Your Exact 2026 Duty Instantly

Importing a car to Kenya in 2026 rewards preparation and precision. With the right information and an experienced partner like Seaways Kenya, the process becomes predictable, transparent, and far less stressful.

This is quite comprehensive, I love how it has broken down step by step and one can easily follow through. I will be reaching out soon.